AI TimeClock streamlines payroll deductions by automating calculations, ensuring compliance with tax laws, custom rulesets and providing detailed reporting. It integrates with payroll systems, enhances security, and offers employee self-service, reducing errors and administrative workload while increasing satisfaction and trust.

A payroll deduction is a set amount of money deducted from an employee’s gross pay to cover a variety of mandatory and voluntary obligations and benefits. Mandatory deductions include federal and state taxes, as well as Social Security and Medicare contributions. Voluntary deductions include health insurance premiums, retirement plan contributions, and charitable donations. Payroll deductions are designed to ensure that employees not only meet their legal tax obligations, but also pay for benefits and services that improve their well-being. CloudApper AI TimeClock streamlines the payroll deduction process by automating calculations with custom rulesets, ensuring legal compliance, and providing detailed reporting and transparency.

For more information on CloudApper AI TimeClock visit our page here.

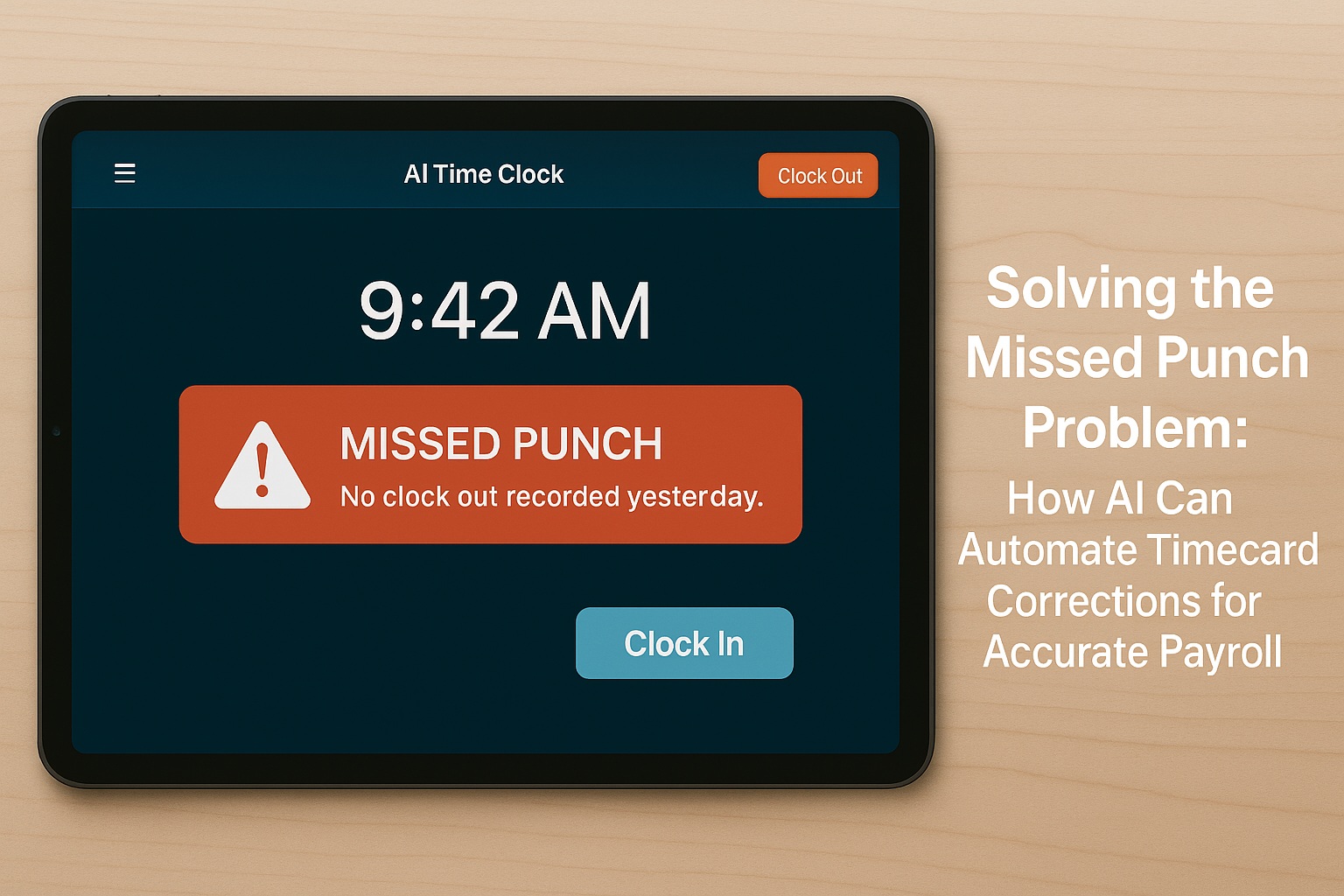

Payroll deduction errors are a significant concern for businesses, as they can lead to costly penalties and damage to a company’s credibility. A 2022 survey by Ceridian revealed that 85% of respondents faced problems with their payroll technologies, and 69% had issues with payroll data.

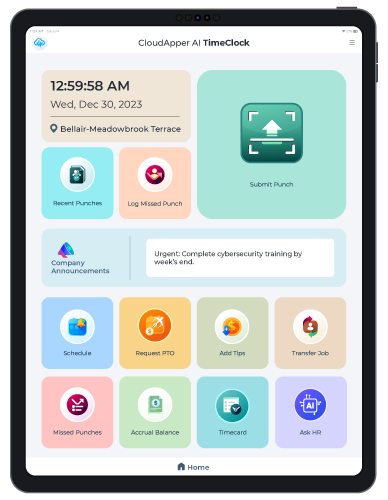

CloudApper AI TimeClock in Payroll Deductions

AI TimeClock automates the calculation of both mandatory and voluntary payroll deductions by integrating with payroll and HCM systems, lowering the risk of human error and saving payroll managers valuable time. This automation ensures that deductions are calculated correctly with custom rulesets based on the most recent tax laws and regulations, reducing the risk of penalties and fines. Some companies have custom rulesets for payroll deductions, and CloudApper AI TimeClock can assist with custom rules and accurate time data collection for a smoother payroll. Furthermore, the system generates detailed pay stubs that clearly outline all deductions, which promotes transparency and trust between employers and employees. Employees can access their pay stubs at any time, which increases satisfaction and reduces payroll-related queries.

Optimizing Payroll Operations

In addition to its automation and integration capabilities, CloudApper AI TimeClock offers enhanced security and data privacy, complying with industry standards and regulations like HIPAA, GDPR, and CCPA. This ensures that all payroll data is securely stored and transmitted, protecting sensitive employee information and reducing the risk of data breaches. The employee self-service portal empowers employees to take control of their benefits and deductions, leading to higher satisfaction and reduced administrative workload for HR departments. Scalability is another key advantage, as the solution can handle the payroll needs of businesses of all sizes, accommodating an increasing number of employees and more complex payroll requirements without compromising performance or accuracy. By automating and streamlining the payroll deduction process, CloudApper AI TimeClock helps reduce administrative costs associated with manual payroll processing, making it a cost-efficient solution for businesses looking to optimize their payroll operations.

CloudApper AI Time Clock

Ingredion’s Adoption of CloudApper AI TimeClock For Contactless Time Punching Through Barcode Scaning

Key Takeaways

- Automated Calculations: CloudApper AI TimeClock automates the calculation of mandatory and voluntary payroll deductions, reducing human error and ensuring compliance with the latest tax laws and regulations.

- Custom Rulesets: The platform supports custom rulesets for payroll deductions, catering to specific company needs and ensuring accurate time data collection.

- Integration with Payroll and HCM Systems: Seamlessly integrates with existing payroll and HCM systems, ensuring synchronized and accurate data across platforms.

- Detailed Reporting: Generates comprehensive pay stubs that outline all deductions, promoting transparency and trust between employers and employees.

- Enhanced Security: Complies with industry standards such as HIPAA, GDPR, and CCPA, ensuring secure storage and transmission of payroll data.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper AI TimeClock

For accurate & touchless time capture experience.

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Customizing Your Time Clock: Building the Perfect Solution with CloudApper…

How an AI HR Assistant in Your Time Clock Reduces…