Navigate California's intricate time clock laws seamlessly with CloudApper AI TimeClock. Tailor attestations, leverage AI assistants for automation, and receive alerts for compliance. The ultimate solution for California businesses prioritizing precision and adherence.

Table of Contents

In order to avoid fines and other legal complications, businesses in California must carefully follow the state’s stringent rules for employee timekeeping. To help businesses understand and comply with California’s complex time clock legislation, this handbook summarizes key points.

For more information on CloudApper AI TimeClock visit our page here.

Key Considerations

Wage Payment

Payment for All Hours: In addition to regular compensation, employees are required to get overtime pay at a rate of 1.5 times their regular rate for any hours worked in excess of 8 per day or 40 per week.

Meal Breaks and Rest Periods: Paid time off does not include meal breaks or the 10-minute rest period that is included for every four hours working.

Extended Breaks: Long breaks (more than half an hour) are not considered work time and are not required to be reimbursed.

Timekeeping Requirements

Accurate Record-Keeping: Companies are required to keep detailed records of their employees’ work schedules, including all breaks (lunch and rest) and beginning and ending times.

Record Accessibility: All records, whether digital or paper-based, should be easily retrievable for staff members to peruse.

Rounding Time: There can be no more than a 30-minute advantage for employers per pay period when time rounding is not fair and consistent.

Grace Periods

Voluntary Grace Periods: Employers in California are free to institute clock-in or clock-out grace periods as long as they are clearly stated in business policy, even if the state does not require them.

Other Important Laws

Donning and Doffing: Workers should be paid for the time it takes to put on and take off their work uniforms or other required safety gear.

Travel Time: Time spent traveling to and from work or between sites is often not counted as work time. Tasks performed on the job and business policy may dictate an exception.

Meal and Rest Break Compliance: The onus is on employers to do what they can to make sure workers get the breaks they need.

CloudApper AI Time Clock

Potpourri Group Inc. Improved Their Efficiency of Employee Time Management with CloudApper AI TimeClock

Resources for Employers

- California Department of Industrial Relations (DIR): California DIR

- U.S. Department of Labor Wage and Hour Division (WHD): U.S. DOL WHD

- California Employment Law Handbook by CalChamber: CalChamber Handbook

Note: To fully comprehend and adhere to California’s complex time clock regulations, it is vital to seek the advice of an HR specialist or attorney, but this book does offer a general outline.

Staying Compliant with CloudApper AI TimeClock

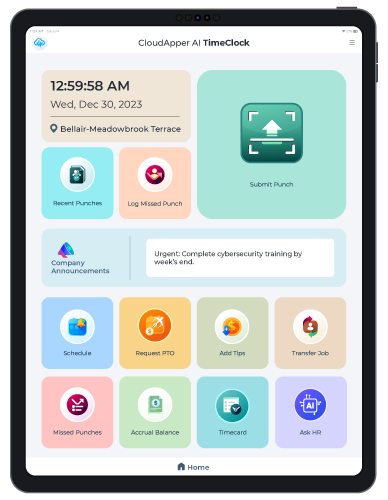

When it comes to California’s time clock laws, CloudApper AI TimeClock has certain advanced capabilities that can help firms stay in compliance:

Custom Attestation: Adjust attestation standards to suit individual regulatory mandates.

AI Assistant:Use an AI-powered assistant to automate HR-related tasks and answer questions.

Alerts and Notifications: Stay up-to-date with the latest alerts and notifications to quickly resolve any potential compliance issues.

With these capabilities, CloudApper AI TimeClock simplifies timekeeping and guarantees compliance with California’s complex rules. It’s a powerful solution for firms that want to be the best at compliance.

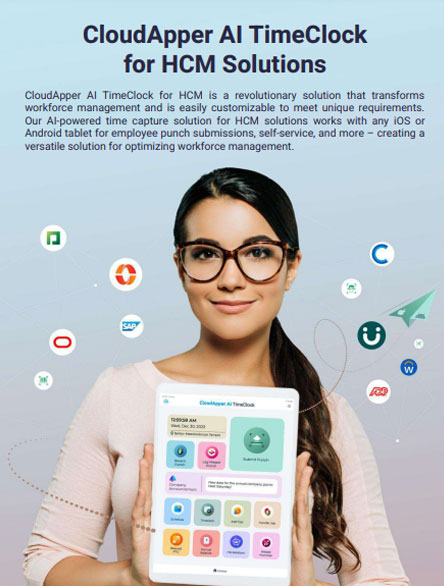

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper AI TimeClock

For accurate & touchless time capture experience.

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

How to Streamline Position and Time Type (PATT) Management in…

How to Eliminate Time Theft in Oracle PeopleSoft Using CloudApper’s…