Table of Contents

Regardless of the industry, organizations need accurate work-hour calculations to maintain compliance, ensure fair employee compensation, and optimize operational efficiency. However, calculating employee work hours can be complex and time-consuming, especially when dealing with intricate details such as diverse schedules, overtime, and various types of leave. Errors in work-hour calculations can lead to significant issues, including financial penalties, legal complications, and employee dissatisfaction. To prevent all of that, a custom AI time capture solution like the CloudApper AI TimeClock can automate complex employee work-hour calculations, making the process seamless and error-free – let’s explore how.

For more information on CloudApper AI TimeClock visit our page here.

Key Takeaways

- CloudApper AI TimeClock automates complex work and break-hour calculations, ensuring accurate and compliant time tracking for organizations.

- The solution integrates with leading HCM systems like UKG, Ceridian Dayforce, Workday, isolved, Infor, and Oracle, providing real-time data synchronization and reporting.

- By reducing administrative burdens and ensuring accurate payroll processing, CloudApper AI TimeClock boosts operational efficiency and employee satisfaction.

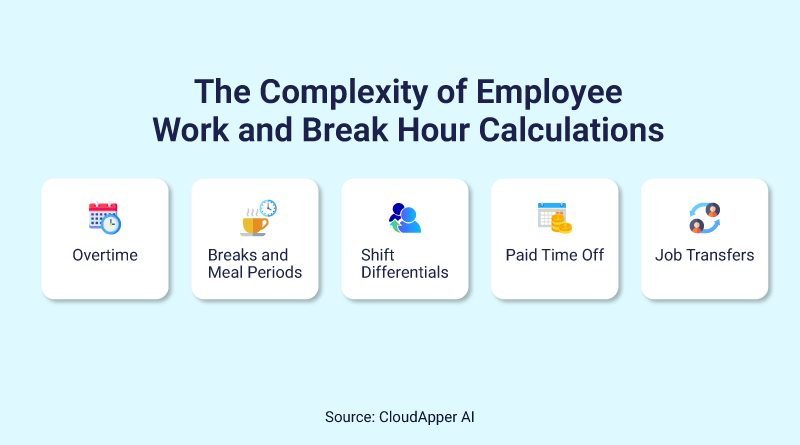

The Complexity of Employee Work and Break Hour Calculations

Accurate calculations of employee work hours involve more than just tracking when employees clock in and out. There are numerous factors that lead to complexities in calculating work and break hours, some of which are:

Overtime

Overtime calculations can be particularly challenging, especially in environments where employees frequently work beyond their scheduled hours. Different jurisdictions have varying laws regarding overtime pay, often requiring time-and-a-half or double-time pay for hours worked beyond a certain threshold. Additionally, company policies might include provisions for overtime pay that go beyond legal requirements. Accurately capturing and calculating these hours is crucial to ensure employees are compensated fairly and to maintain compliance with labor laws.

Breaks and Meal Periods

Recording breaks and meal periods correctly is essential for both compliance and employee well-being. Many labor laws mandate specific break times and meal periods based on the number of hours worked. Failure to provide or accurately record these breaks can lead to penalties and legal issues. Moreover, ensuring that these periods are not counted as paid work hours requires precise tracking.

According to California labor laws, employees are entitled to a 30-minute meal break for every five hours worked.

Shift Differentials

Manufacturing plants, hospitals, and other organizations that operate around the clock often have shift differentials – different pay rates for different shifts, such as night shifts or weekend shifts. Calculating these differentials accurately is essential to ensure that employees receive the correct compensation for the hours worked during these times. Miscalculations can lead to payroll errors, affecting employee satisfaction and trust.

Paid Time Off

Integrating various forms of paid time off, such as vacation days, sick leave, and personal days, into work-hour calculations adds another layer of complexity. Each type of PTO may have different accrual rates and usage rules. For example, vacation days accrue based on hours worked, while sick leave is granted at the beginning of the year. Accurately tracking and calculating PTO ensures that employees receive the correct benefits and that the organization remains compliant with employment laws.

Job Transfers

In many industries, employees may work on multiple tasks or projects within a single shift, each with different pay rates. For example, a factory worker might spend part of their shift operating a machine (pay rate A) and another part performing quality control (pay rate B). Accurately tracking these job transfers is essential for correct payroll processing and project cost accounting. Failure to do so can result in significant payroll discrepancies and impact project budgets.

As can be clearly understood, employee work-hour calculations are not only vast but can also be complex. Inaccurate calculations can have severe repercussions, affecting not only an organization’s financial health but also its compliance with labor laws and overall employee satisfaction.

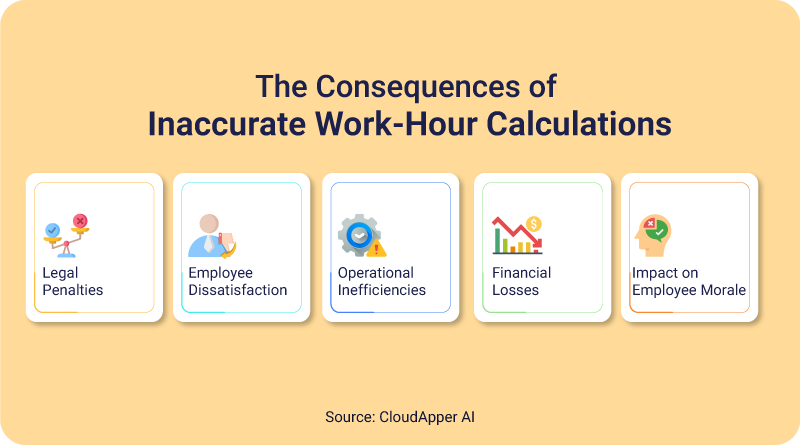

The Consequences of Inaccurate Work-Hour Calculations

Here are some of the key consequences of inaccurately calculating employee work hours:

Legal Penalties

Non-compliance with labor laws due to inaccurate calculations can lead to significant legal penalties. When organizations fail to pay their workers correctly, it results in fines and back-pay orders.

The U.S. Department of Labor (DOL) enforces strict regulations regarding wage and hour compliance, and violations can lead to costly lawsuits and settlements.

Additionally, repeated non-compliance can damage an organization’s reputation and lead to increased scrutiny from regulatory bodies.

Employee Dissatisfaction

Employees have a very natural expectation that they will be paid accurately and on time for the hours they put in. When errors occur, such as underpayment or incorrect overtime calculations, it can lead to dissatisfaction and a loss of trust in the employer. Dissatisfied employees are more likely to seek employment elsewhere, leading to higher turnover rates. High turnover not only disrupts operations but also incurs additional costs related to recruiting and training new staff. Maintaining accurate work-hour calculations is essential for fostering a positive work environment and retaining top talent.

Operational Inefficiencies

Manual calculations and error correction are time-consuming processes that divert HR resources from more strategic tasks. When HR teams spend excessive time correcting payroll errors and reconciling discrepancies, they cannot focus on workforce planning, talent development, and other critical HR functions.

Financial Losses

Inaccurate employee work-hour calculations can lead to both overpayments and underpayments, directly impacting an organization’s financial health. Overpayments result in unnecessary expenses, while underpayments can lead to legal disputes and compensation claims. Moreover, errors in calculating shift differentials, overtime, and PTO can accumulate over time, leading to substantial financial losses.

Impact on Employee Morale

Frequent errors and discrepancies in payroll processing can often lower employee morale and trust. When employees are unsure whether they will be paid correctly, it creates anxiety and reduces their engagement and productivity. Over time, this can lead to a toxic work environment and decreased overall performance.

Addressing these complexities and consequences with a reliable and automated employee time capture solution like the CloudApper AI TimeClock can ensure accurate work-hour calculations, compliance with labor laws, and improved employee satisfaction.

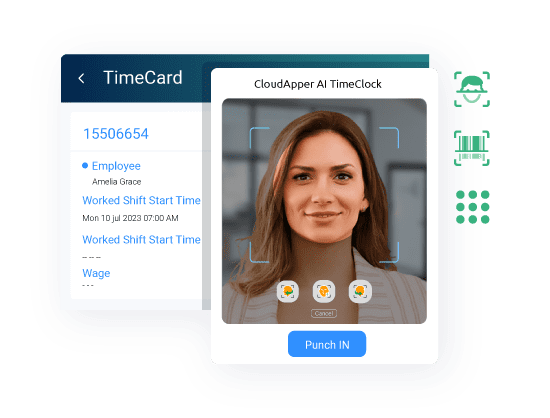

CloudApper AI TimeClock for Automating Complex Work and Break Hour Calculations

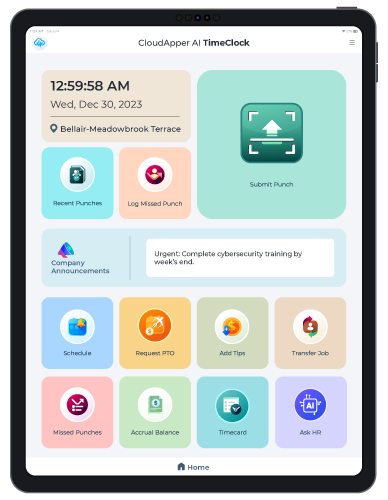

CloudApper AI TimeClock is a custom employee time capture solution designed to automate calculations of employee work hours. By transforming Android tablets and iPads into secure and user-friendly time clocks, CloudApper AI TimeClock helps organizations capture accurate employee punch-ins and outs and automate these complex calculations while seamlessly integrating with HCM systems such as UKG, Ceridian Dayforce, Workday, isolved, Infor, Oracle, and more.

Key Features of CloudApper AI TimeClock

Automated Time Tracking

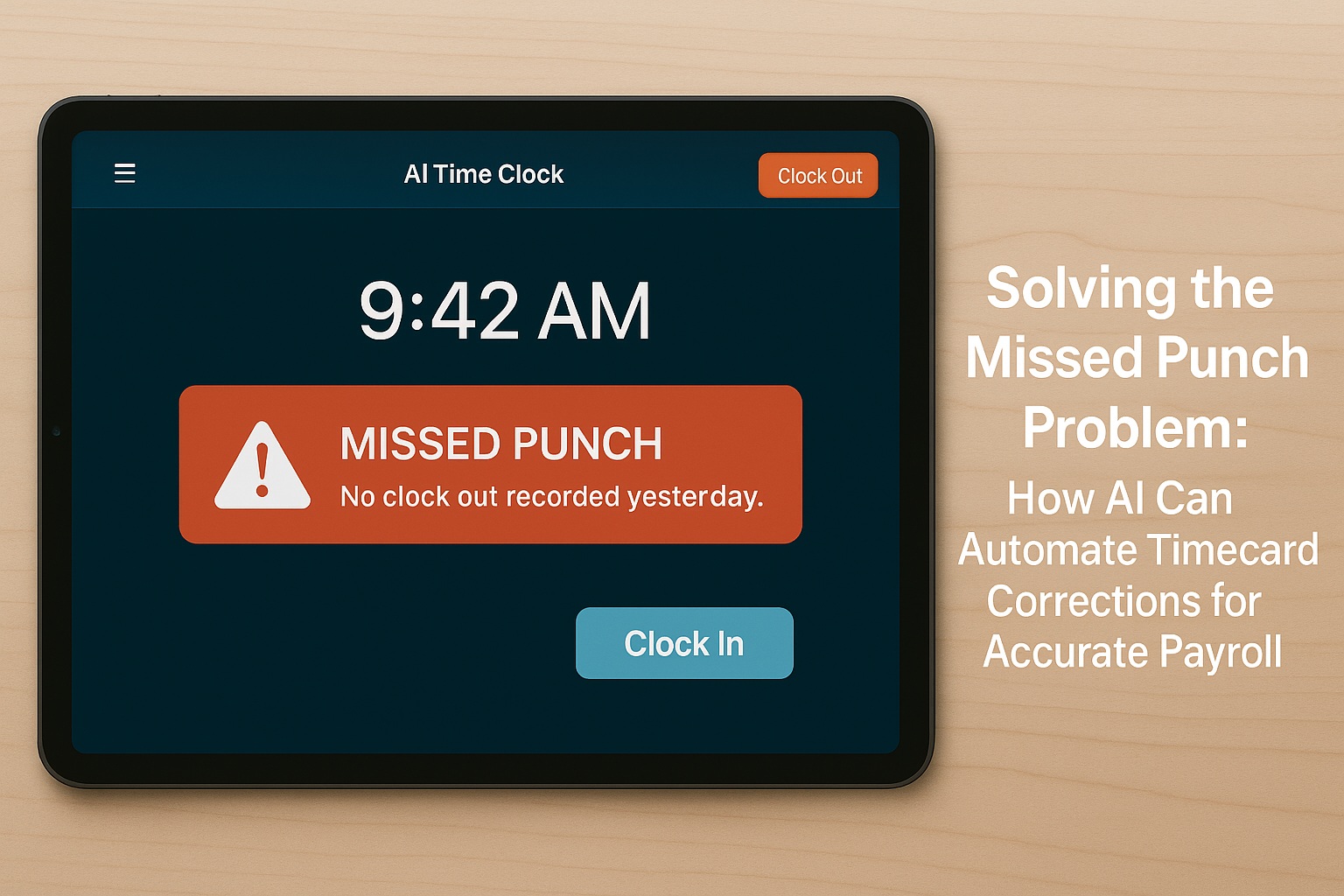

CloudApper AI TimeClock captures employee clock-ins and outs, including break hours, with precision. Employees can easily punch in and out using Android tablets or iPads, ensuring that all work hours are accurately recorded.

Customizable Data Capture

The solution allows HR teams to configure and capture custom data points necessary for accurate work-hour calculations, including job transfers, overtime, and shift differentials.

CloudApper AI Time Clock

R.D. Offutt Farms use CloudApper AI TimeClock's Barcode/QR Code Solution for Employee Time Capture

Seamless Integration With HCM and Payroll Systems

As mentioned, CloudApper AI TimeClock integrates seamlessly with leading HCM and payroll systems, automatically synchronizing all captured data for accurate payroll processing and compliance.

Real-Time Data and Reporting

Managers can access real-time data and generate detailed reports on employee work hours, breaks, and overtime – helping them make better decisions and tackle issues swiftly.

AI-Powered Automation

The AI-powered solution automates complex calculations regarding employee work and break hours, reducing the risk of human error and ensuring that employees are compensated accurately based on their hours worked and applicable pay rates.

Benefits of Using CloudApper AI TimeClock

Enhanced Accuracy and Compliance

Automating complex calculations with CloudApper AI TimeClock ensures that all employee hours are accurately recorded and compliant with labor laws, minimizing legal risks as well as payroll discrepancies.

Increased Efficiency

By automating time tracking and complex work duration calculations, HR teams can focus on strategic initiatives rather than manual data entry and error correction, resulting in improved operational efficiency, reduced HR burden, as well as resource optimization.

Improved Employee Satisfaction

Accurate and timely payroll processing leads to employees getting paid fairly and on time, boosting trust and satisfaction among them. When employees are confident that their work hours are accurately tracked and compensated, it enhances their overall work experience and engagement.

Cost Savings

Automating work-hour calculations reduces administrative costs and minimizes the risk of overpayments or underpayments. This contributes to better financial management and cost savings for the organization.

Automate Complex Work-Hour Calculations Now

Accurate work-hour calculations are essential for maintaining compliance, ensuring fair compensation, and optimizing operational efficiency. CloudApper AI TimeClock provides a powerful solution to automate these complex calculations, transforming Android tablets and iPads into secure and user-friendly time clocks. By integrating seamlessly with leading HCM systems, CloudApper AI TimeClock helps organizations streamline their timekeeping processes, reduce administrative burdens, and enhance employee satisfaction. Contact CloudApper AI today to learn how our custom employee time capture solution can meet your unique requirements and automate complex calculations.

FAQs

How does CloudApper AI TimeClock help with calculating work hours?

CloudApper AI TimeClock uses AI-powered technology to capture employee clock-ins and outs, including breaks and job transfers. It then automates the calculation of work hours, overtime, and shift differentials, ensuring accurate payroll processing.

What devices does CloudApper AI TimeClock support?

CloudApper AI TimeClock is compatible with Android tablets and iPads, transforming them into secure and user-friendly time clocks for capturing employee work hours.

How well does CloudApper AI TimeClock integrate with third-party systems?

CloudApper AI TimeClock seamlessly integrates with leading HCM systems like UKG, Ceridian Dayforce, Workday, isolved, Infor, and Oracle, as well as leading payroll systems. This integration ensures that all captured data is automatically synchronized for accurate and compliant payroll processing.

What are the benefits of automating complex work and break-hour calculations with CloudApper AI TimeClock?

The benefits include enhanced accuracy and compliance, increased efficiency, improved employee satisfaction, cost savings, and scalability. Automating the calculations of employee work hours reduces administrative burdens and ensures accurate payroll processing.

We have custom requirements – can the solution be customized to meet our specific needs?

Of course – the custom employee time capture solution offers a plethora of customization options. We can configure the solution to capture specific data points, such as job transfers and shift differentials, ensuring that the system meets the unique requirements of the organization – contact us now to learn more about it.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More