Conversational AI is reshaping the banking and finance industry, delivering human-like interactions, automating routine tasks, and enhancing customer experience. With benefits such as cost savings, streamlined operations, and personalized services, it's a strategic necessity for future success. Embrace the Conversational AI revolution with CloudApper today!

Table of Contents

Conversational AI is a game-changer in the dynamic banking and finance industry, where efficiency in operations and satisfaction of customers are paramount. This state-of-the-art technology is more than a passing fad; it’s a powerful instrument with the ability to revolutionize customer service, operational efficiency, and competitive advantage for financial institutions. In addition, enterprise AI solutions can improve risk management by analyzing massive volumes of data to detect fraud and forecast financial threats. Financial organizations can streamline compliance operations by integrating enterprise AI solutions, ensuring that regulatory obligations are fulfilled quickly and properly.

The Rise of Conversational AI in Banking and Finance

The banking and financial business has been revolutionized by conversational AI, which is driven by sophisticated chatbots and virtual assistants. Delivering encounters that are reminiscent of real ones, automating mundane chores, and offering customized help around the clock are the three main reasons why this technology is booming. Let’s explore the various ways Conversational AI is changing the industry and its many uses.

1. Delivering Human-Like Interactions

Conversational AI aims to provide banking and finance with interactions that are reminiscent of human conversations. Artificial intelligence (AI) chatbots mimic human speech to greet, help, and lead customers through a variety of tasks. Customers are more likely to have a good impression of the financial institution and its services as a result of this.

2. Streamlining Routine Operations

When it comes to automating mundane tasks in the banking and financial industry, conversational AI really shines. It can quickly manage a variety of operational activities, answer questions about missing debit or credit cards, and smoothly lead clients through Know Your Customer (KYC) procedures. Employees will have less routine work to do, and customers will have a better experience overall.

3. Resolving Issues Swiftly

Problems that customers face frequently necessitate prompt attention. When things go wrong, as when you need to report a misplaced credit card, conversational AI steps in with immediate answers. By walking users through each step, the AI chatbot speeds up and simplifies the process of resolving their issues.

4. Improving Account Holder Experience

A major step toward better service for account holders is conversational AI. Customers have a stronger sense of connection to their financial institutions when they receive individualized interactions, round-the-clock assistance, and rapid handling of requests. As a result, general contentment and devotion are boosted.

5. Reducing Operational Costs

Conversational AI can save operating expenses, which is a real gain. Saving a lot of money is possible for financial institutions by automating common queries and procedures. Chatbots powered by AI can process several requests in parallel, making the most efficient use of available resources.

6. Automating Repetitive Tasks

Conversational AI is great at replacing humans with machines for mundane, repetitive jobs. Chatbots may automate routine activities like customer onboarding, feedback collection, and compliance, allowing humans to focus on higher-level, more difficult work.

7. Educating Account Holders

Conversational AI goes beyond only answering banking service related questions; it also acts as a teaching tool for account users. Customers may keep updated about advantageous bargains by providing information about general financial management, deadlines, and investment options.

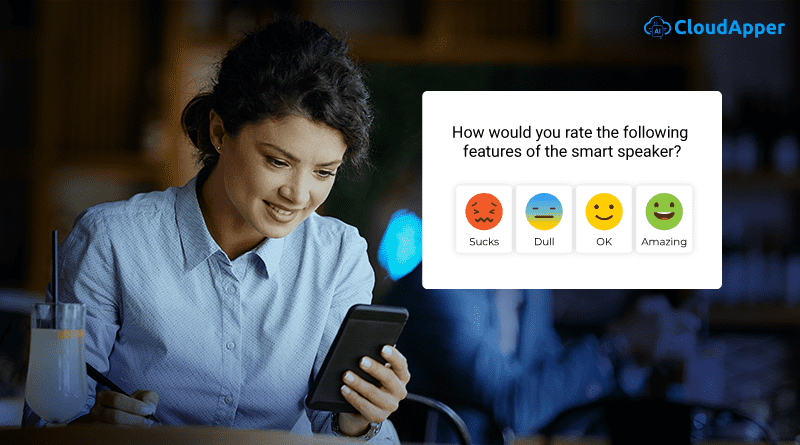

8. Feedback and Compliance

Conversational AI makes it easier to comply with industry laws while still collecting useful input from account holders. Financial organizations may enhance their services continuously by streamlining the feedback process and refining them based on insights.

9. Customer Onboarding Simplified

Conversational AI streamlines the often-criticized customer onboarding process. With the platform’s help, banks and other financial institutions can have productive onboarding interactions and quickly collect the data they need.No need to fill up lengthy paper based account opening forms anymore.

10. Enhancing Operational Efficiency

As a whole, Conversational AI helps improve operational efficiency by doing mundane but necessary activities automatically. In order to simplify their operations and concentrate on higher-value tasks, financial institutions can optimize workflows and reduce manual involvement.

Benefits of Conversational AI in Banking

With its many benefits for consumers and banks alike, conversational AI has quickly become an industry game-changer. Customers no longer have to waste time and effort on inconvenient methods of contact like phone calls or in-person meetings thanks to this technological advancement. Banks may easily improve customer experience by automating many routine banking activities with simple voice queries or chatbot interactions.

With this technology, banks may better connect with their customers, which in turn lowers operating costs and increases employee efficiency. Bank employees may do more complicated responsibilities, such handling client complaints or offering individualized financial advice, if typical customer encounters are automated. Conversational AI also allows banks to provide personalized service suggestions to customers by analyzing past history and preferences.

Significant cost savings are also achieved through the use of Conversational AI in the banking industry. Automating mundane queries and processes helps financial firms save time and money while letting employees focus on higher-level, more complex work. A more streamlined workflow and better use of resources are the results of this increased operational efficiency, which permeates many banking processes.

In addition, banks may find new ways to make money and improve their services with the help of Conversational AI, which gives them vital data on client behavior and preferences. Banks may enhance their goods and services by analyzing client interaction using machine learning algorithms. This allows them to get insights into customer journeys.

The ever-increasing demand for immediate assistance may be met by utilizing Conversational AI, which guarantees client support at all times. Customer satisfaction is boosted by its availability all day, every day. By responding quickly to questions, fixing common issues, and walking clients through troubleshooting, customer service is made more efficient. As a result, problems are resolved quickly, and customers are more satisfied and loyal.

Simply put, conversational AI is changing the way banks operate by making interactions more streamlined, tailored, and efficient. This, in turn, benefits customers, helps save costs, and gives innovative banks a leg up in the market.

The Future of Banking and Finance with Conversational AI

The introduction of conversational AI has revolutionized the way banking and finance industries engage with clients and oversee daily operations. Conversational AI is proving to be an important tool for the future of financial institutions. It can mimic human interactions, automate mundane operations, and offer tailored help.

Unparalleled benefits, such as individualized customer service, substantial cost reductions, and round-the-clock assistance, are becoming available to financial institutions as they adopt this revolutionary technology. To keep up with the ever-changing banking and finance industry, conversational AI is more than simply a tool; it’s a strategic need.

Get Ready for the Future

Rather than only responding to new circumstances, banks and other financial organizations that use Conversational AI are really creating it. Conversational AI is the first step toward a better customer experience, lower operating expenses, and more efficient operations. Put this revolutionary power to work for your bank and lead it to new heights of success.

Embark on the Conversational AI Revolution Today!

To find out how this cutting-edge technology may transform your financial and banking processes, get in touch with CloudApper Conversational AI. Utilize Conversational AI to revolutionize your client experience, remain efficient, and remain ahead of the curve!

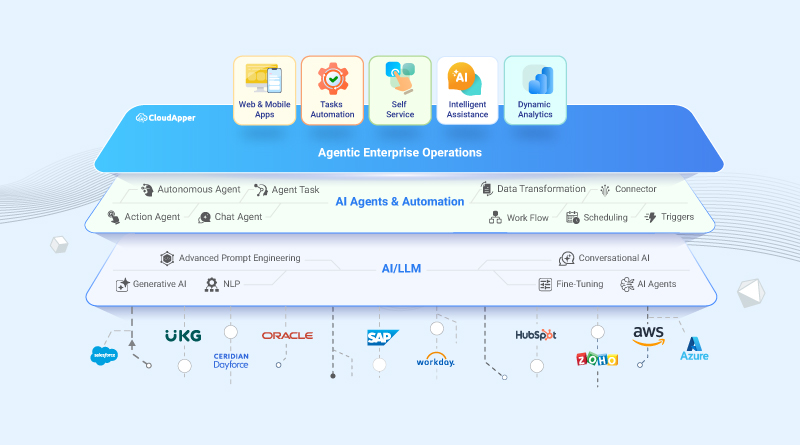

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

What Experts Say About Enterprise Business Automation & Why You…

Enterprise Automation with AI Agents: How to Streamline Your Business…