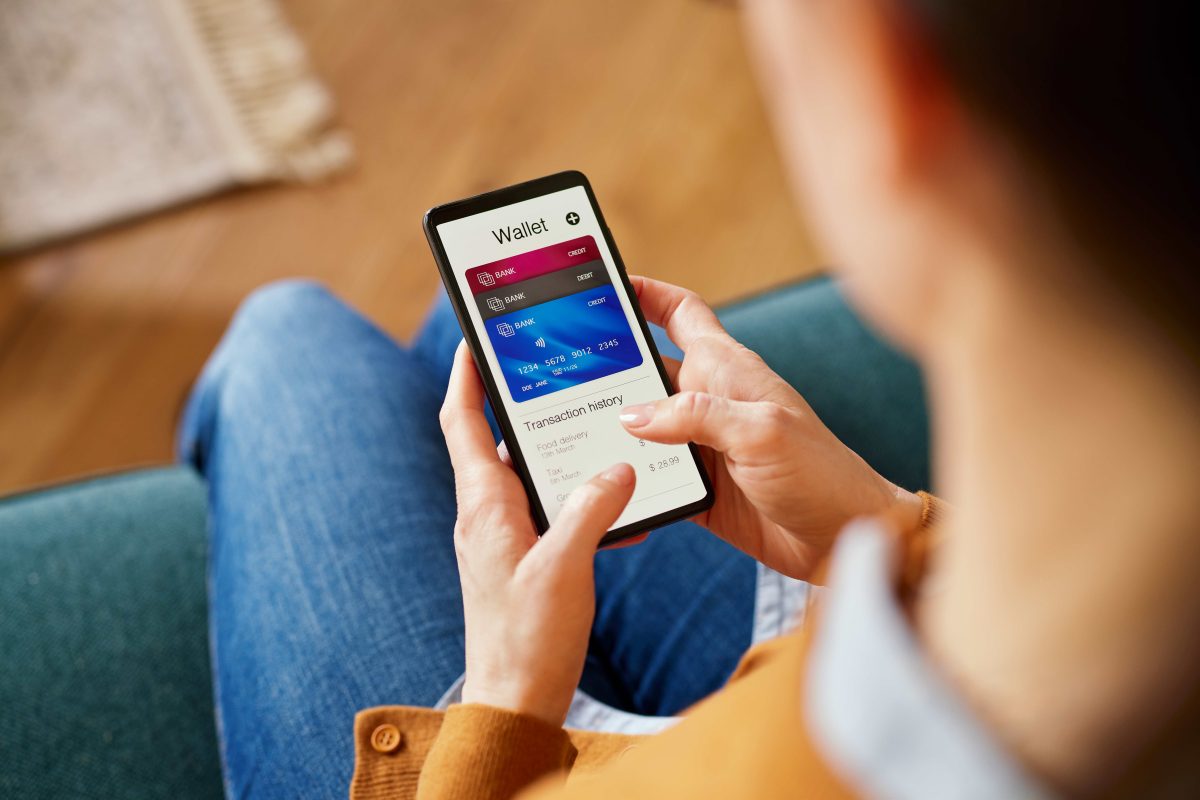

AI in banking is transforming customer interactions, risk management, and efficiency. CBA and BBVA use AI to streamline operations and enhance service. CloudApper Conversational AI offers banks tools to improve engagement, reduce costs, and optimize workflows.

Table of Contents

AI in banking is revolutionizing how financial institutions handle customer interactions, risk management, and operational efficiency. Banks like Commonwealth Bank of Australia (CBA) and BBVA have successfully integrated AI to streamline operations and improve customer service.

CBA’s AI banking system manages over 50,000 daily inquiries, reducing customer wait times and easing the workload on human agents. BBVA has deployed ChatGPT Enterprise to improve productivity across multiple departments, from risk management to HR and finance.

Financial institutions looking to implement similar automation can leverage CloudApper Conversational AI to enhance customer engagement, reduce costs, and optimize internal workflows.

How CloudApper Conversational AI Improves Banking Operations

1. AI Banking for Customer Support

Managing thousands of customer inquiries daily is a challenge for any bank. Long wait times, inconsistent responses, and high operational costs make traditional call centers inefficient.

CBA’s AI system automates responses to common banking queries, ensuring customers get quick and accurate information. Banks can achieve the same results with CloudApper Conversational AI, which:

- Responds instantly to FAQs about account details, loan applications, and transactions.

- Reduces the workload on human agents by handling routine inquiries.

- Provides 24/7 customer support, eliminating long wait times.

By implementing CloudApper, banks can improve customer satisfaction while reducing the costs associated with large customer service teams.

2. AI for Employee Productivity

BBVA implemented AI banking solutions to improve employee productivity and streamline internal operations. They automated tasks in legal, risk, marketing, talent management, and finance, reducing manual workload and increasing efficiency.

CloudApper Conversational AI helps banks automate internal workflows by:

- Providing AI-based assistance for retrieving documents, policies, and compliance guidelines.

- Automating task management to improve efficiency in fraud detection, compliance, and loan processing.

- Reducing manual errors by integrating AI into existing banking systems.

By adopting CloudApper, banks can enhance employee productivity and streamline internal operations, just like BBVA.

3. AI Banking for Fraud Detection & Risk Management

Security threats and fraudulent activities are growing concerns in banking. AI can help detect and prevent fraud in real-time.

CloudApper Conversational AI improves fraud prevention by:

- Monitoring transactions and detecting anomalies before fraud occurs.

- Sending real-time alerts for suspicious activity.

- Providing automated risk assessment to improve compliance and security.

By integrating AI banking solutions for fraud detection, banks can reduce financial risks and protect customer assets.

4. AI for Loan Processing & Financial Advisory

Loan applications and financial advisory services require time-consuming document verification and customer support. AI can automate and accelerate these processes.

With CloudApper Conversational AI, banks can:

- Automate loan application processing, reducing approval time.

- Provide AI-based financial guidance, improving customer decision-making.

- Ensure compliance with regulations, reducing manual workload for banking teams.

By leveraging AI, banks can improve loan processing efficiency and offer better financial services.

Why Banks Need CloudApper Conversational AI

The success of CBA and BBVA proves that Conversational AI is the future. Banks that invest in AI solutions will gain a competitive advantage by:

- Automating customer interactions for faster response times.

- Optimizing workforce productivity by eliminating manual tasks.

- Enhancing fraud detection and risk management with real-time AI monitoring.

- Improving financial services through AI-based automation.

CloudApper Conversational AI helps banks achieve all of these benefits, offering a seamless AI banking experience.

Explore AI Banking Solutions with CloudApper

Conversational AI is transforming financial services, and institutions must embrace AI automation to stay competitive. CloudApper Conversational AI provides the advanced automation, fraud detection, and customer support banks need to thrive in a digital-first world.

Explore CloudApper Conversational AI Today and Transform Your Banking Operations

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper hrPad

Empower Frontline Employees with an AI-Powered Tablet/iPad Solution

Download Brochure

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Conversational AI: The Key to Happy, Satisfied Customers

Revolutionize Enterprise Applications with AI-Powered Chatbots