AI assistants like CloudApper hrGPT streamline payroll management by automating inquiries, providing accurate, 24/7 responses, and integrating seamlessly with existing systems. This enhances HR efficiency, reduces errors, and improves employee satisfaction, offering a scalable and cost-effective solution for growing businesses.

Table of Contents

AI assistants are software apps that use natural language processing (NLP) and machine learning algorithms to imitate human communication. They can comprehend and respond to text or speech commands, making them perfect for automating repetitive chores. AI assistants are used in enterprises to provide customer service, technical support, data analysis, and human resource functions. By automating these chores, AI assistants allow human employees to focus on more important duties, increasing overall productivity.

Key Takeaways

Automating payroll inquiries with AI assistants such as CloudApper hrGPT increases efficiency by freeing up employees in HR for key functions. It ensures exact and consistent replies, which reduces the possibility of errors. Employees have continuous access to help, which improves accessibility and satisfaction. This technology eliminates the need for large HR manpower and provides a cost-effective alternative. Furthermore, hrGPT’s scalability enables it to properly handle a high volume of questions, making it suitable for developing businesses.

CloudApper hrGPT: Handling Payroll-Related Questions

CloudApper hrGPT is an excellent AI assistant for handling payroll-related queries. This is how it works.

Automated Query Handling: Employees can ask hrGPT a number of payroll-related questions, including salary data, deductions, and tax information. hrGPT responds promptly, providing accurate and consistent results.

24/7 Availability: hrGPT is available 24 hours a day, seven days a week, allowing employees to get their payroll questions answered without having to wait for HR office hours.

Seamless Integration: hrGPT connects seamlessly with existing payroll systems, ensuring that the information provided is up-to-date and correct.

User-Friendly Interface: The chatbot is designed to be intuitive, making it accessible to staff with varying degrees of technological expertise.

Success Story

A financial corporation implemented hrGPT and saw a 30% reduction in payroll processing time, with significant improvements in accuracy.*

Challenges of Manual Payroll Management

Managing payroll manually creates various issues for HR departments:

Time-Consuming Processes: It includes manually calculating salaries, deductions, and taxes.

Error Risk: Manual data entry raises the possibility of errors, which can result in pay discrepancies and compliance difficulties.

Limited Accessibility: Employees frequently have to wait for HR office hours to have their payroll questions resolved, which can cause delays and frustration.

Resource Allocation: Many HR resources are focused on monotonous chores, leaving little time for strategic projects.

“Getting my payroll questions answered instantly through hrGPT has made my work experience so much better.”- employee at healthcare company*

Benefits of Using CloudApper hrGPT

Implementing CloudApper hrGPT provides several benefits.

Efficiency: Automates repetitive payroll inquiries, allowing HR workers to focus on more complicated responsibilities.

Accuracy: Provides exact and consistent responses, lowering the likelihood of errors associated with human payroll handling.

Accessibility: Payroll information is available 24/7, allowing employees to access it at any time.

Cost-Effectiveness: Minimizes the requirement for considerable HR manpower, resulting in cost savings.

Scalability: Capable of handling an increasing volume of questions as the company grows.

Conclusion

AI assistants, such as CloudApper hrGPT, are changing payroll management by responding to employee queries in real-time, accurately and consistently. This technology not only increases HR productivity but also substantially boosts the work experience. Organizations that want to improve their payroll procedures and give greater support to their employees may consider incorporating AI assistants like hrGPT into their HR systems. Contact CloudApper to discover more about how this unique AI assistant may help your business.

FAQs

1. How does hrGPT ensure accurate payroll responses?

hrGPT leverages powerful NLP and connects with payroll systems to offer correct data.

2. Can hrGPT handle complicated payroll inquiries?

Yes, hrGPT can handle a wide variety of payroll-related inquiries, such as salary information, deductions, and taxes.

3. Is hrGPT available outside of usual office hours?

Yes, hrGPT is available 24/7 to assist as needed.

4. How user-friendly is hrGPT?

hrGPT is developed with an intuitive interface that all employees may use.

5. What are the financial advantages of adopting hrGPT for payroll management?

hrGPT decreases the need for large HR manpower while minimizing errors, resulting in significant cost savings.

*Disclaimer: Due to privacy reasons, the identity of the person or company cannot be revealed.

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

CloudApper AI Solutions for HR

- Works with

- and more.

Similar Posts

Auto-Clear Timesheets Using API Workflows: Save HR Hours

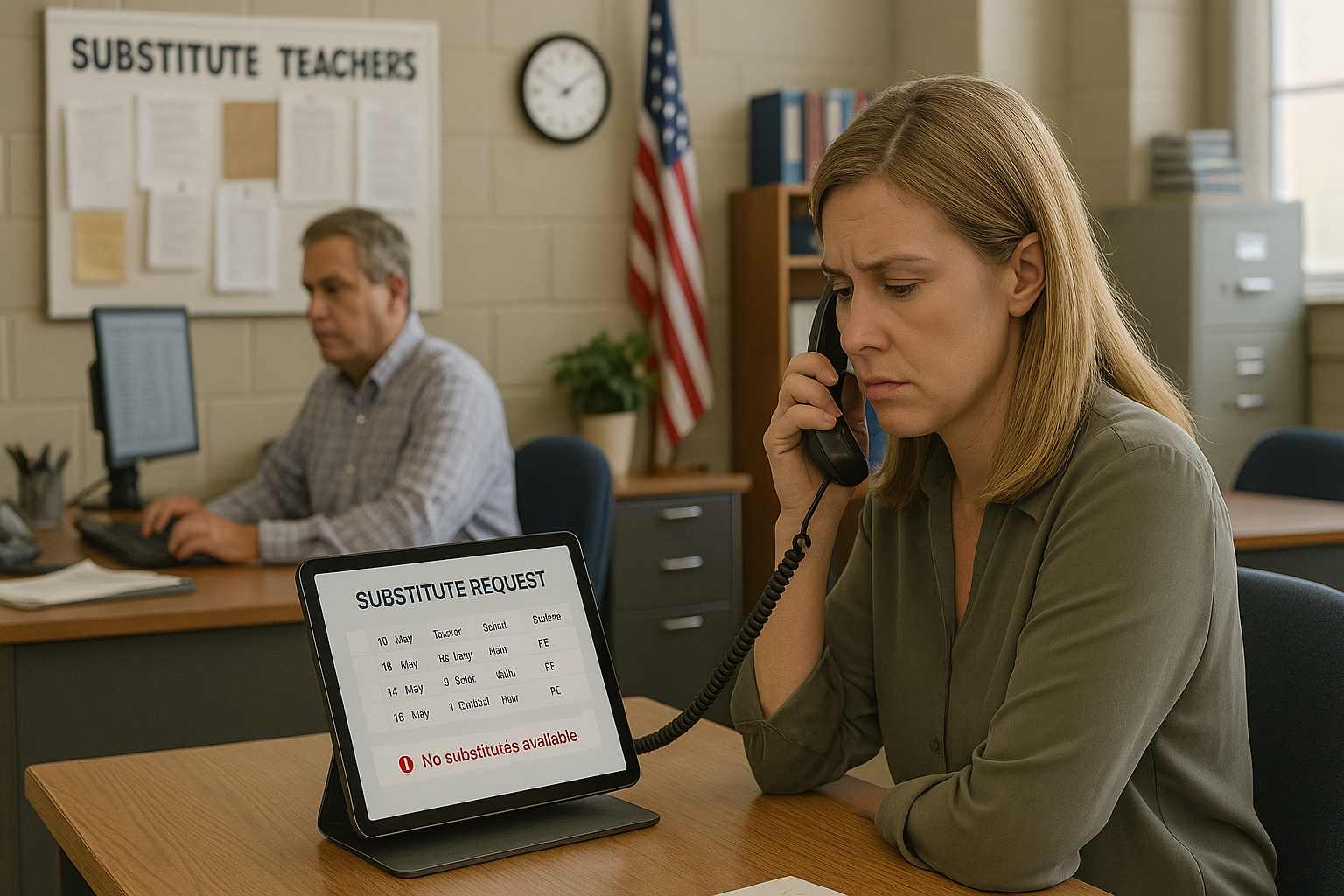

How School Districts Are Solving Substitute Management Without Changing Their…