CloudApper AI offers AI-powered chatbots tailored for financial institutions, enhancing customer engagement, operational efficiency, and cost-effectiveness. These chatbots provide instant, accurate assistance to customers, optimizing workflows and improving the overall banking experience.

Table of Contents

Are financial institutions ready for the next frontier in client interaction? With customer expectations at an all-time high, the financial sector faces mounting pressure to deliver fast, accurate, and personalized service. The answer lies in AI-powered chatbots, tools that are transforming how banks and financial organizations connect with their clients.

As an experienced HR tech consultant working closely with financial institutions to streamline operations, I’ve witnessed firsthand how AI chatbots are reshaping customer interactions. A regional bank I collaborated with struggled to handle customer queries efficiently, especially during peak hours. Implementing an AI chatbot reduced their query resolution time by 60%, boosting customer satisfaction scores by 45% within the first three months.

According to a 2023 study by Juniper Research, financial institutions that adopt chatbots can expect operational cost savings of $7.3 billion globally by 2025, thanks to reduced reliance on human agents for routine inquiries. Moreover, a Gartner report states that by 2027, chatbots will become the primary customer service channel for more than 25% of organizations in the financial sector—a testament to their growing importance.

CloudApper AI stands at the forefront of this revolution, equipping financial institutions with robust AI chatbot solutions that do more than just answer FAQs. Our chatbots leverage advanced natural language processing (NLP) to deliver personalized, context-aware responses that enhance client satisfaction and retention. For instance, instead of a generic reply about “loan options,” our solutions guide customers through tailored recommendations based on their unique financial history and goals.

This shift isn’t just about convenience; it’s about fostering trust in an increasingly digital world. AI chatbots ensure round-the-clock support, an invaluable asset in today’s always-connected society. 80% of customers are more likely to remain loyal to a brand that provides instant support, according to an IBM survey.

By implementing AI chatbots, financial institutions not only meet modern customer demands but also drive operational efficiency and reduce costs. CloudApper AI empowers organizations to embrace this transformation seamlessly, staying ahead in a competitive market while focusing on delivering exceptional value to clients.

Experience, expertise, and proven results: that’s what CloudApper AI brings to the table for the financial sector.

Understanding the Need for AI Chatbots in Finance

Amid the dynamic financial environment, clients have higher expectations of their financial institutions. They require prompt and precise information regarding financial policies and services. In order to uphold consumer happiness and loyalty, financial institutions must promptly and efficiently address these inquiries. AI chatbots for financial institutions are utilized in this context. Financial institutions may optimize their operations, enhance consumer engagement, and save expenses by using the capabilities of artificial intelligence (AI).

Use Cases of AI Chatbots in Finance

| Use Case | Description | Benefits |

|---|---|---|

| Customer Support | AI chatbots handle frequently asked questions, account inquiries, and policy explanations 24/7. | Reduces response times, improves customer satisfaction, and cuts operational costs. |

| Loan Applications | Guides customers through loan eligibility checks, document submissions, and application statuses. | Streamlines processes, reduces errors, and improves customer experience. |

| Fraud Detection | Identifies unusual account activity and notifies customers instantly. | Boosts security and trust while reducing fraud losses. |

| Payment Reminders | Sends automated reminders for due payments, bills, or loan installments. | Improves payment compliance and reduces late payment issues. |

| Customer Onboarding | Assists new clients with account setup, policy understanding, and required documentation. | Simplifies onboarding processes and enhances customer retention. |

| Data Insights | Analyzes customer interactions to provide actionable insights for improving services. | Helps in strategic decision-making and product development. |

| Regulatory Compliance | Provides consistent, regulation-compliant responses to customer queries. | Reduces risk of non-compliance and associated penalties. |

How CloudApper AI Can Help

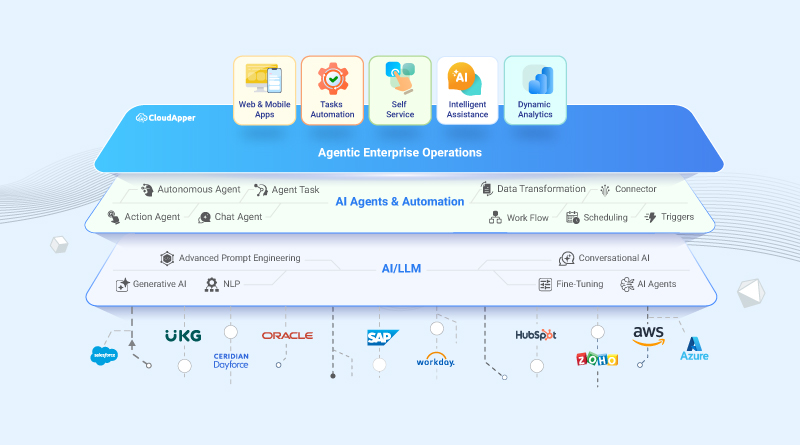

CloudApper AI is a state-of-the-art AI/LLM platform that allows financial institutions to effortlessly integrate AI chatbots with their current systems. Our technology is specifically developed to facilitate policy and general customer care tasks, hence improving the overall customer experience. CloudApper AI enables financial organizations to:

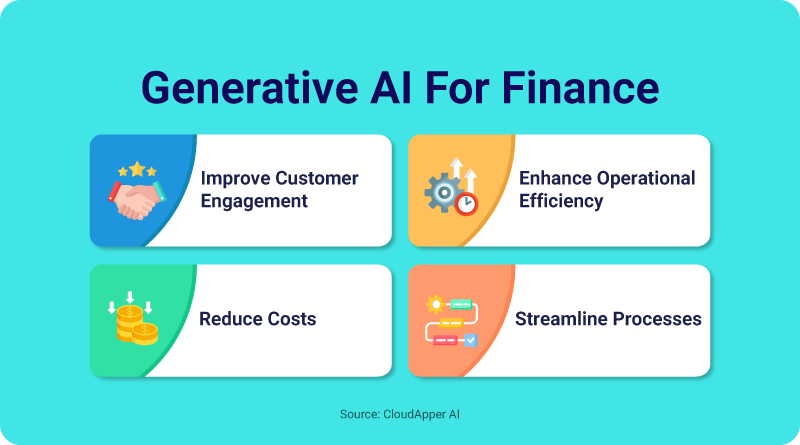

Improve Customer Engagement: AI chatbots have the capability to offer clients prompt and precise information regarding their accounts, policies, and services, enabling them to actively participate in managing their financial affairs.

Enhance Operational Efficiency: AI chatbots can allow the automation of many mundane operations so that human agents can focus their attention on higher, more value-adding tasks.

Reduce Costs: Chatbots significantly reduce the expenses of customer service because they are accessible round the clock and can make instantaneous replies to consumer queries.

Streamline Processes: AI chatbots can optimize customer onboarding, loan applications process, and other day to day tasks by facilitating guided interactions, hence enhancing the overall customer experience.

Success Story: Transforming Banking Customer Service with AI Chatbots

A leading bank faced challenges in managing a high volume of customer inquiries and loan applications efficiently. By integrating CloudApper AI chatbots into their existing systems, they achieved substantial improvements in customer engagement and operational efficiency.

With CloudApper AI, the bank automated routine customer service tasks, such as answering frequently asked questions, processing loan applications, and providing real-time account information. Within six months, the bank saw a 45% reduction in customer service costs and a 50% improvement in response times. The streamlined processes led to a 35% increase in customer satisfaction scores and a 25% rise in loan approvals.

By leveraging CloudApper AI, the bank not only optimized their operations but also enhanced their customer service, setting a new benchmark for efficiency and customer satisfaction in the banking industry.

Benefits of AI Chatbots in Finance

There are various advantages of utilizing AI chatbots in the field of banking. Financial organizations may optimize customer interaction, boost operational efficiency, minimize expenses, and expedite operations by utilizing AI chatbots. AI chatbots can offer data-driven insights, assisting financial firms in recognizing patterns in customer behavior and areas of dissatisfaction, hence enabling the development of product and business development initiatives.

“Implementing CloudApper AI chatbots has revolutionized our customer service operations. Within six months, we achieved a 50% reduction in operational costs and a 45% improvement in response times. The AI chatbots provided valuable data-driven insights that helped us identify and address areas of customer dissatisfaction, leading to a 30% increase in customer satisfaction scores and a significant boost in customer retention rates.”

— Chief Operations Officer, with 18 years of experience in the Financial Industry*

Conclusion

AI chatbots are revolutionizing the banking sector by offering financial organizations a potent tool to enhance customer experience and optimize operational efficiency. CloudApper AI’s AI chatbot for financial institutions is specifically engineered to optimize policy and general customer care functions, hence augmenting the entire customer experience. Financial companies may enhance client engagement, minimize expenses, and optimize workflows by integrating AI chatbots into their current systems. With the ongoing evolution of the financial industry, the significance of AI chatbots will inevitably increase.

*For privacy reasons, the customer’s identity and specific company name have not been disclosed.

Key Takeaways

- Enhanced Customer Engagement: CloudApper AI chatbots provide clients with immediate, accurate information about their accounts, policies, and services, empowering them to manage their financial affairs actively.

- Operational Efficiency: AI chatbots automate routine tasks, freeing human agents to focus on more value-adding activities, improving overall efficiency.

- Cost Reduction: Available 24/7, chatbots significantly lower customer service costs by providing instant responses to inquiries.

- Streamlined Processes: From customer onboarding to loan applications, AI chatbots optimize various processes, enhancing the overall customer experience.

- Data-Driven Insights: AI chatbots offer valuable insights into customer behavior and areas of dissatisfaction, enabling financial firms to develop better products and business strategies.

FAQ Section: AI Chatbots in Finance

1. What are AI chatbots in finance?

AI chatbots in finance are artificial intelligence-powered virtual assistants designed to interact with customers, answer queries, and provide personalized financial guidance. They utilize natural language processing (NLP) and machine learning (ML) to deliver fast, accurate, and context-aware responses.

2. How do AI chatbots benefit financial institutions?

AI chatbots benefit financial institutions by:

- Enhancing customer engagement through personalized and instant responses.

- Automating routine tasks, freeing up human agents for more strategic roles.

- Reducing operational costs by providing 24/7 customer support.

- Streamlining processes such as customer onboarding and loan applications.

- Offering data-driven insights to improve services and customer satisfaction.

3. Can AI chatbots handle complex financial inquiries?

Yes, advanced AI chatbots can handle complex financial inquiries by accessing customer data securely, analyzing context, and providing accurate information or guidance. For example, they can assist with loan eligibility checks, detailed account summaries, and investment recommendations.

4. Are AI chatbots secure for financial transactions?

AI chatbots in finance prioritize security and compliance. Reputable solutions, like those offered by CloudApper AI, adhere to industry standards such as GDPR, CCPA, and FIPS, ensuring secure handling of sensitive financial information.

5. How do AI chatbots improve customer satisfaction?

AI chatbots improve customer satisfaction by:

- Reducing response times for inquiries.

- Offering 24/7 availability.

- Providing personalized, data-driven recommendations.

- Ensuring consistent and reliable support, even during peak hours.

6. Can AI chatbots integrate with existing financial systems?

Yes, AI chatbots, including those developed by CloudApper AI, seamlessly integrate with existing financial systems such as CRMs, loan management software, and core banking systems, enhancing functionality without requiring significant changes to infrastructure.

7. What tasks can AI chatbots automate in finance?

AI chatbots can automate tasks such as:

- Responding to frequently asked questions.

- Customer onboarding processes.

- Loan applications and eligibility checks.

- Account management support.

- Payment reminders and updates on financial policies.

8. How do AI chatbots reduce costs for financial institutions?

AI chatbots reduce costs by:

- Minimizing reliance on human agents for routine inquiries.

- Operating 24/7 without additional overhead.

- Decreasing error rates in customer interactions.

- Streamlining operational workflows for faster task completion.

9. What makes CloudApper AI’s chatbot solution unique for financial institutions?

CloudApper AI’s chatbot solution is tailored for financial institutions, offering:

- Advanced NLP capabilities for personalized responses.

- Seamless integration with existing financial systems.

- Data-driven insights to improve customer engagement strategies.

- Scalability to adapt to the institution’s evolving needs.

10. How can AI chatbots help with compliance in finance?

AI chatbots assist with compliance by:

- Providing accurate information about financial policies and regulations.

- Ensuring consistent communication aligned with legal requirements.

- Logging interactions for audit trails and compliance reporting.

11. What challenges can AI chatbots help financial institutions overcome?

AI chatbots help overcome challenges like:

- Managing high volumes of customer inquiries.

- Meeting customer expectations for instant support.

- Reducing human errors in routine tasks.

- Improving customer retention through personalized service.

12. How can small financial institutions benefit from AI chatbots?

Small financial institutions can use AI chatbots to:

- Compete with larger banks by offering 24/7 support.

- Improve efficiency with limited resources.

- Provide personalized customer service without scaling staff.

13. What future trends can we expect for AI chatbots in finance?

Future trends include:

- Integration with blockchain for enhanced security.

- Expansion into investment advisory services.

- Greater use of predictive analytics for proactive customer engagement.

- Advanced personalization powered by generative AI.

14. How can financial institutions get started with AI chatbots?

Financial institutions can start by:

- Identifying key areas for automation (e.g., customer service or loan applications).

- Partnering with a trusted provider like CloudApper AI.

- Implementing chatbots in phases to ensure smooth integration and adoption.

15. Are there any limitations to AI chatbots in finance?

While AI chatbots are highly efficient, they may have limitations, such as:

- Inability to handle highly nuanced or emotional customer concerns.

- Dependence on quality training data for accurate responses.

- Potential integration challenges with outdated legacy systems.

By addressing these FAQs, we aim to provide valuable insights into AI cha

What is CloudApper AI Platform?

CloudApper AI is an advanced platform that enables organizations to integrate AI into their existing enterprise systems effortlessly, without the need for technical expertise, costly development, or upgrading the underlying infrastructure. By transforming legacy systems into AI-capable solutions, CloudApper allows companies to harness the power of Generative AI quickly and efficiently. This approach has been successfully implemented with leading systems like UKG, Workday, Oracle, Paradox, Amazon AWS Bedrock and can be applied across various industries, helping businesses enhance productivity, automate processes, and gain deeper insights without the usual complexities. With CloudApper AI, you can start experiencing the transformative benefits of AI today. Learn More

Brochure

CloudApper hrPad

Empower Frontline Employees with an AI-Powered Tablet/iPad Solution

Download Brochure

CloudApper AI Solutions

- Works with

- and more.

Similar Posts

Building a Privacy-Preserving Chatbot with Amazon Bedrock and CloudApper AI

What Are The Steps For AI Chatbot Development and Integration?